How Corporate Buyers Can Benefit From EV Tax Incentives in India

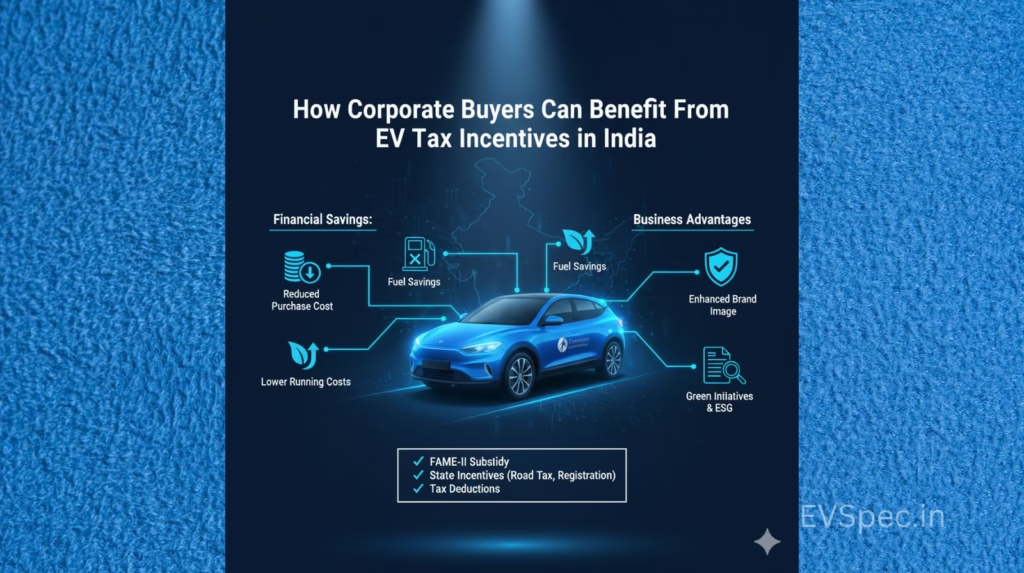

Electric vehicles (EVs) are no longer just a green move, they are now a smart financial decision for businesses and corporate fleets across India. With the government rolling out lucrative EV tax incentives, reduced GST, and accelerated depreciation, corporate buyers stand to gain big. This guide breaks down the process, benefits, application, and practical tips in a simple, actionable way, making it easy for any company leader or procurement team to understand.

Why Should Corporates Consider EVs?

- Lower running and maintenance costs

- Powerful government incentives

- Improved brand image and ESG compliance

- Future-proofing against pollution and emission regulations

Electric vehicles are now a credible asset for fleet, logistics, and staff mobility, helping corporates save money and contribute to sustainability simultaneously.

Key Tax Benefits for Corporate EV Buyers

1. Reduced GST on Electric Vehicles

- The current GST (Goods & Services Tax) rate on EVs in India is just 5%, compared to up to 28% on regular petrol/diesel vehicles.

- GST on charging stations and related services is also 5%.

- This slashes the up-front buying cost for companies procuring multiple vehicles.

2. Input Tax Credit (ITC)

- Businesses can claim ITC on the GST paid when purchasing electric vehicles for business use.

- This means you can reduce your overall tax liability and operating expense.

- ITC can also be claimed on GST paid on charging station installation, battery purchases, and EV fleet maintenance.

3. Accelerated Depreciation (Section 32 of Income Tax Act)

- EVs qualify for higher rates of depreciation under Section 32, often 40% or more per annum for commercial fleet assets.

- Accelerated depreciation allows companies to write off asset value faster, reducing taxable income and boosting cash flow in early years.

4. FAME-II Subsidy & State Incentives

- Under the FAME-II scheme, the government provides direct purchase incentives up to ₹10,000/kWh for company-registered EVs (mainly commercial vehicles, two- and three-wheelers).

- Many states offer additional cashbacks, reduced road tax, and registration fee waivers when corporate fleets buy EVs—check your local EV policy for details.

5. Reduced Road Tax and Registration Fees

- Electric vehicles in most states pay lower road tax and registration charges, further reducing acquisition costs for large fleets.

6. Cheaper Finance and Loans

- Some banks and NBFCs offer lower-interest loans for corporate EV purchases, taking advantage of government guarantees and green finance schemes.

Step-by-Step: How Corporates Can Avail EV Tax Benefits

Step 1. Assess Needs and Select Eligible EV Models

- List out required vehicle types (cars, vans, scooters, etc.).

- Choose models that qualify for GST, FAME, and state incentives (pure electric, not hybrids).

Step 2. Buy Directly in Company Name

- Tax benefits are only available if vehicles are registered in the business name and used for commercial purposes.

Step 3. Use GST-Compliant Vendors and Dealers

- Purchase from authorized dealers who generate proper GST invoices.

- This is crucial for Input Tax Credit (ITC) claims.

Step 4. Claim Input Tax Credit and Depreciation

- Declare GST paid as ITC in company tax returns.

- Account for the full vehicle cost under Section 32 for accelerated depreciation.

Step 5. Apply for Subsidies

- Register for FAME-II and state-level incentives via designated portals or through vendor assistance.

- Ensure all documentation (purchase invoice, business PAN, vehicle papers) is in order.

FAQs: Frequently Asked Questions

Q1. Can a business claim input tax credit (ITC) on electric vehicle purchase?

Answer: Yes, businesses buying EVs for commercial use can claim ITC on the GST paid for the vehicle, reducing overall expense.

Q2. What is the current GST on electric vehicles for corporates?

Answer: It’s 5% for pure electric vehicles, much lower than the regular 28% on petrol/diesel cars.

Q3. Are there specific subsidies for commercial fleet EVs under FAME-II?

Answer: Yes, FAME-II gives direct cash incentives to fleet/commercial buyers based on battery size and vehicle type.

Q4. Is accelerated depreciation available for corporate EV buyers?

Answer: Yes, Section 32 allows higher depreciation rates, letting corporates write off EV costs faster and reduce taxable profit.

Q5. Is there any benefit for setting up corporate EV charging stations?

Answer: Yes, companies enjoy reduced GST (5%) and can claim ITC on charging equipment and installation.

Q6. What documents do companies need to avail these benefits?

Answer: GST-compliant purchase invoice, PAN and GST details of company, vehicle registration papers in company name, proof of usage for business.

Q7. Can startups and small businesses also avail these benefits?

Answer: Yes, all registered businesses—including startups and MSMEs—can access EV tax incentives when buying for commercial use.

Q8. Does buying EVs improve ESG ratings for corporates?

Answer: Absolutely. Adopting EVs boosts environmental and social governance scores, attracting green-conscious clients and investors.

Q9. Are there state-specific incentives for corporate EV adoption?

Answer: Many states offer extra benefits like lower road tax, registration fee waivers, and additional subsidies—always check state EV policy.

Q10. Can corporates lease EVs and still get tax benefits?

Answer: Leasing arrangements may qualify for some benefits, but check specifics with your CA or lease provider.

Conclusion

Switching to electric vehicles is not just an eco-friendly move for Indian corporates, it’s now a calculation that pays off in real rupees. Reduced GST, accelerated depreciation, input tax credits, and direct incentives mean lower costs and smarter tax planning. When you consider additional benefits like state waivers, subsidized charging infrastructure, and improved brand reputation, EVs should be high on the consideration list for any company looking to upgrade their fleet.

By understanding and leveraging these benefits, corporate buyers can drive forward both profit and sustainability.